More a migrant than a refugee.

Gilles’ experiences raise questions about the different challenges facing migrants and refugees. Initially from Rwanda, Gilles is now a registered Uber driver and explains how his savings practices, family, and fake IDs helped him find stability.

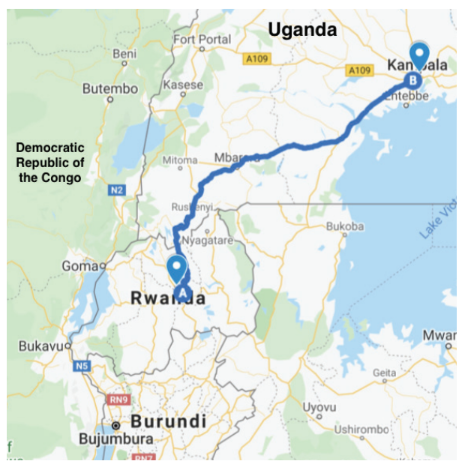

“I decided to come to Uganda to look for greener pastures,” said Gilles. The 25-year-old left Rwanda in 2013 with the hope of finding a better job in Kampala. “The problem is I did not finish school. I started, but dropped out,” Gilles explained. “I was in a Teachers’ Training College, but there was no money to finish the course.” Like his mother, a primary school teacher, he had long planned to work in education but needed to find a more financially viable career path.

Gilles’s mother and five siblings remain in Rwanda, and Gilles aspires to save enough money to purchase a plot of land on which he can one day live with his family. Literally and metaphorically, Gilles dreams of greener pastures.

“My friends, who came here before me, told me that there are good opportunities here. At first, it was not easy, but I tried,” Gilles said. His mother paid for his transportation to Kampala, a cost of 60,000 shillings ($16.20), and Gilles was able to stay with friends while settling in and looking for a job. It was a cramped environment – a single room, two mattresses, four people. While not fitting the definition of a refugee, Gilles heard from others that he would be welcome in Uganda because of the country’s openness to refugees.

Uganda, Gilles said, offered more opportunities for the Hutu in particular. “There is opportunity for Tutsi [in Rwanda]. If you are a Hutu, you have to struggle because of the 1994 genocide.” While his mother remains employed in Rwanda, Gilles’s siblings have struggled to find any job, let alone more desirable or lucrative ones.

Upon arrival, Gilles found work cleaning a salon, earning 3,000 shillings a day ($0.81), an amount barely sufficient for basic food needs, so he still relied heavily on his friends’ support. After a six-month stint at the salon, Gilles decided to rent a motorcycle and work as a driver. He paid the motorbike’s owner 60,000 shillings ($16.20) per week, making an average of 30,000 ($8.10) per day. “It was a good deal,” he recalled. Gilles continued this arrangement for the next year and a half while continuing to live with his friends.

During this time, Gilles was diligent about saving money “under the mattress.” He said he trusts his friends deeply and never had any money stolen. He later registered his phone with a mobile money company and transitioned to saving in the mobile wallet. By the time he had saved 700,000 shillings, fate had intervened and presented an investment opportunity. Someone was selling a motorbike for 1,000,000 shillings ($270.20). Gilles asked one of his uncles back in Rwanda to help him with the remaining 300,000 ($81.00), which his uncle promptly sent via Airtel Mobile Money.

Between the conscientious saving and his uncle’s generosity, Gilles could purchase his own bike, thus graduating him from errand boy to small business owner. He quickly began to see financial returns, earning between 50,000–200,000 ($13.50–$54.00) per week. Gilles chose to open an account at Equity Bank, where he could save and manage larger sums. But, in order to do so, he needed a Ugandan ID card. Gilles said he encountered no issues when he bribed a government official 20,000 shillings ($5.40) to secure a Ugandan ID, in this case, a driver’s license. It was a relatively easy and inexpensive process. Still, Gilles is wary of the fact that he now carries both Rwandan and Ugandan IDs, hoping that it won’t one day cause problems.

In 2019, Gilles began to befriend more and more Ugandans, including a “rich man who had a car that was registered with Uber.” This more affluent friend convinced Gilles to sell the motorbike and arranged for Gilles to borrow the car and drive for Uber instead. Gilles sold the motorbike for the same price he once paid for it and used the money to enroll in driving school and become officially registered as an Uber driver.

“I paid him 150,000 ($40.50) per week and earned 400,000 ($108.00) per week,” Gilles said. With increased income, Gilles could afford to live alone with a rent of 50,000 ($13.51) per month. He has also been able to grow his savings. “In a good week, I save 300,000–400,000 shillings ($81–$108),” he said. “While in a bad week, I save 200,000 ($54).”

Gilles began to see the fruits of his labor. He was able to start sending money to his mother and siblings via Airtel. And while he had to pay it off over installments, Gilles was able to purchase a plot of land in Rwanda for his mother (a cost of 180,000 francs or $196.70).

Working for Uber has allowed Gilles to save substantially more than he could on his motorbike and move to a better house where rent is 113,000 ($30.50) per month and includes electricity. “Life is very, very good; I want to buy my own car,” Gilles said. He attributed his relative success and momentum to his habits of saving and staying focused on his goals. Many of Gilles’s friends have returned to Rwanda. “They didn’t know how to save,” he said. “They loved women and living a good life, yet they did not have a lot of money,” he continued. Today, most of Gilles’s friends are Ugandan, and he has grown suspicious of Rwandans. “Some of them are spies,” he claimed.

Gilles continues to grow in his financial life, looking forward to one day being his own boss. A newly imported car would cost him around 15,000,000 ($4,053), but he believes he can find a used car for a lower price. Once Gilles buys a car, he plans to build a house for his mother on the land he bought for her. He also wants to bring his thirteen-year-old brother to Kampala for his education. As a child, Gilles dreamed of becoming a doctor, but he did not get that opportunity. Now, he hopes his brother will study medicine. At least for his little brother, Gilles says, that dream is in reach.