High costs and legal obstacles lead a South Sudanese man to travel to Uganda by foot.

Jackson, a businessman, finds himself fleeing South Sudan not just once, but twice, and endures being separated from his family for years while he tries to establish his livelihood. His lack of official status keeps financial security out of reach.

Jackson and I sat in front of St. James Church in Kampala. Behind us, the women’s choir was rehearsing that Sunday’s hymns. It seemed too peaceful a setting to be discussing such a tumultuous journey.

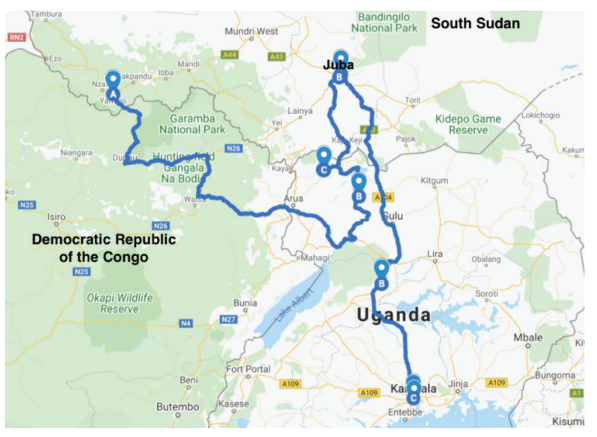

“It took us a month to walk to Uganda through the Congo. We survived on wild fruits that we found in the bush,” Jackson told me. Jackson, 32, once made a living selling clothing in South Sudan, but in June 2015, he fled his hometown amid the violence between government soldiers and the rebel militia. One of his brothers had been captured, tortured, and killed for refusing to join the militia. To avoid meeting the same fate, Jackson had no choice but to flee the country.

Jackson connected with a group of others unwilling to join the militia, and together they trekked through the Congolese forest for weeks to reach the Ugandan border safely. Some of Jackson’s companions knew the terrain fairly well; they also asked for directions along the way. I asked him why he chose to make the cross-country journey informally and on foot. “If I were to use the [legal] immigration side, it would have cost me money to cross the border. I had only SSP 1,000 ($22.20),” Jackson explained.

At home, he wasn’t wealthy, but he could access credit to grow a business. When he chose to start a retail shop back in South Sudan, he needed to borrow money from neighboring businessmen with bigger shops in order to begin his venture. “To boost my business, I could take out a loan from my fellow businessmen, the ones I personally knew, not just anyone... Sometimes I repaid the exact amount and other times I would add something small.” Most of his lenders charged no interest, and Jackson was eventually able to repay all of his loans and generate a profit.

At the start of the war, Jackson’s shop was looted and his savings were stolen. I asked why he had kept the money in cash as opposed to a bank:

“The banking system in South Sudan is very poor. Once you save your money in the bank, you are not allowed to withdraw the whole amount. You can only withdraw in small amounts. Sometimes they tell you that the network is not working. If you deposit SSP 10,000 ($222), they tell you that you can only withdraw SSP 2,000 ($44.00) ... How can you do business with such a bank unless you are just saving money with them?”

For the purposes of a business account, he clarified, the banking service was not only unhelpful but an added burden. To run a business, he said, reliable access to capital was crucial.

None of this mattered, though, after Jackson learned of his brother’s murder. Jackson was devastated. As the situation grew increasingly unstable, Jackson encouraged his wife to take their two-year-old son and go live with her aunt in a more secure region of the country. He did not want to subject his family to the harrowing journey to the border, nor the stress of a refugee camp. After weeks of traveling, Jackson and his group finally reached Aliwara in the Congo, where they were directed to Bidi Bidi. By then, the men had grown weary. “We were all very tired,” he said.

The camp did not offer the respite or support Jackson had hoped for. The registration process was taking so long that, after two months, Jackson decided to return to South Sudan.

“After staying in the camp’s reception for two months, I met a friend I knew from Juba who was doing business in the camp and was soon returning to Juba,” Jackson explained. “I told him, ‘my brother, don’t leave me to die, take me with you.’ We went together and he paid for my transport 60,000 shillings ($16.20) ... He also paid a fine of $50.00 at the border.”

Once in Juba, Jackson worked briefly as a taxi conductor, sending money to his family sporadically whenever a trusted colleague traveled to that region and was willing to transport the cash. Even with a little income, the family still struggled to pay for food and medication, let alone any transport money to help them reunite. But the chaos and bloodshed of the war soon followed him to Juba, too, and Jackson was forced to flee the country once more. This time he went to Kiryandongo, Buyale camp, using all the money he had at the time, 30,000 shillings ($8.10), for transport.

When he arrived at Kiryadongo, Buyale, Jackson learned that the registration of South Sudanese refugees had stopped. He explored the possibility of registering as an urban refugee in Kampala but soon found out that too was no longer an option. He could have bribed an official, he said, but he didn’t have the 200,000 shillings ($54) they would have demanded. The only other option, he was told, would be to travel to Bidi Bidi, where they were still registering refugees.

Between the expensive bus fare to get to Bidi Bidi and the anticipated 3+ month waiting period to complete the registration process, Jackson decided against making the trip. “There are no jobs in Bidi Bidi,” he elaborated. “I tried the first time I was in the camp and there was nothing to do. It is also the reason I went back to Juba.”

Jackson decided to remain in Kampala and learn to manage without identification or legal refugee status, which, he said, has not been easy. “It is affecting me so much,” he lamented. “There is nothing I can do besides the simple casual work ... If I had the ID, by now, I could have ventured into business. There is a bank here (UGAFODE, Microfinance Limited) that is offering loans to refugees.” Sadly, Jackson cannot avail himself of those services as they too require a refugee ID.

It is Jackson’s ambition to run his own business, specifically a small restaurant. For the time being, he has been working as a waiter in one of the restaurants in town and has mastered the tricks of the trade. He started out earning 5,000 shillings ($1.30) per day but now earns 10,000 shillings ($2.70) per day. While he is glad for his income, he has no choice but to live frugally. Jackson recalled eating customers’ leftovers for some of his meals.

Jackson continues to feel disheartened, as though he is “doing nothing.” He longs for a job with “adequate pay” or the opportunity to begin his own business. However, he is grateful that his wife and son were finally able to join him in Kampala in 2019 after many years apart. This reunion, he said, was only possible because of the generosity of his wife’s kin and her hard work as a hairdresser. Without the refugee ID card, Jackson’s son cannot be admitted to a government school, which is all Jackson can afford right now. To enroll their child in a private school (as they aspire to), Jackson and his wife would need approximately 200,000 shillings ($54.00), an amount out of their reach.

Despite his meager earnings, Jackson is determined to save. From his earnings of 10,000 ($2.70) per day, Jackson takes care to put half into a mobile money savings account. At the end of each month, he uses these savings to buy food items like rice, beans, posho (maize meal), cooking oil, and charcoal in bulk quantities intended to last them a whole month. He leaves a small amount in his account to buy fresh vegetables on the days they need them.

Until he can obtain a refugee ID, Jackson is left feeling stuck, just barely getting by.