A side hustler juggles multiple part-time jobs to weather financial storms.

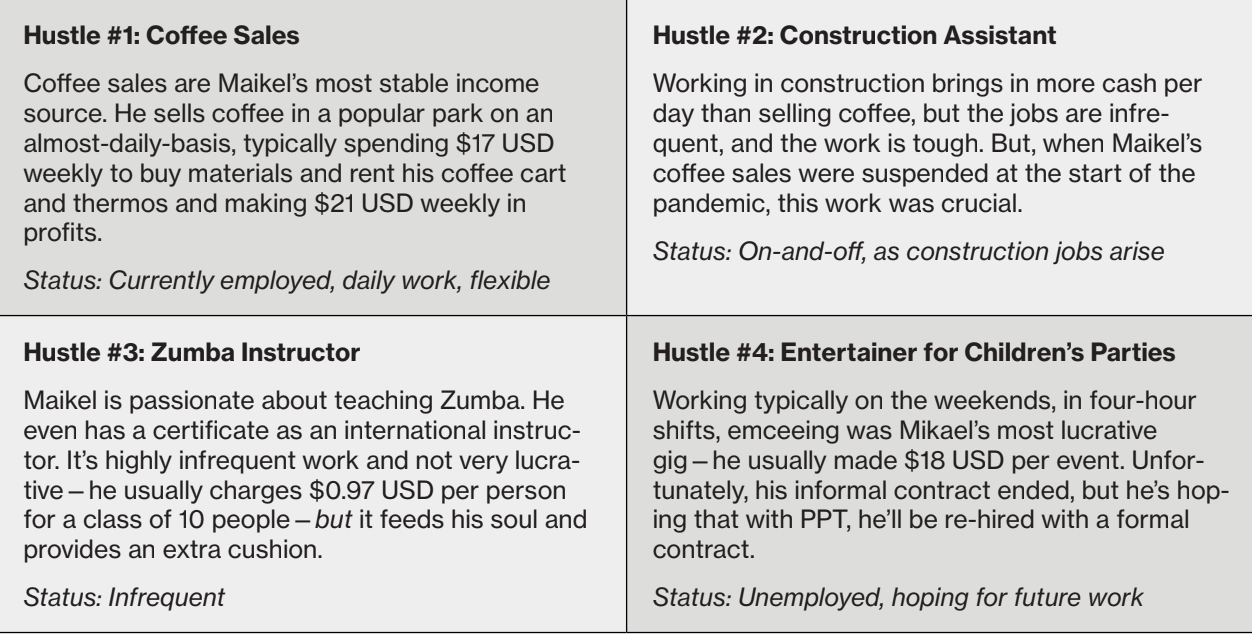

Maikel is an extroverted community leader who has achieved financial stability by simultaneously pursuing four side hustles. He sells coffee from a cart, works as a construction assistant, teaches the occasional Zumba class, and emcees children’s parties. He has managed to meld these hustles to hedge against the chance of negative financial shocks. Although he hasn’t been able to validate his degree or exercise his profession in Colombia, his resourcefulness and energetic personality have allowed him to constantly stitch together multiple gigs as they become available, usually allowing him to get by month to month.

Maikel’s infectious smile knows no bounds: it lures in coffee customers, lights up children’s birthday parties, and gets Zumba classes bouncing. He’s an energetic and engaged 29-year-old who is willing to try anything and get to know anyone. His enthusiasm is what has helped him support himself financially since leaving his home and entire family in Venezuela in 2019.

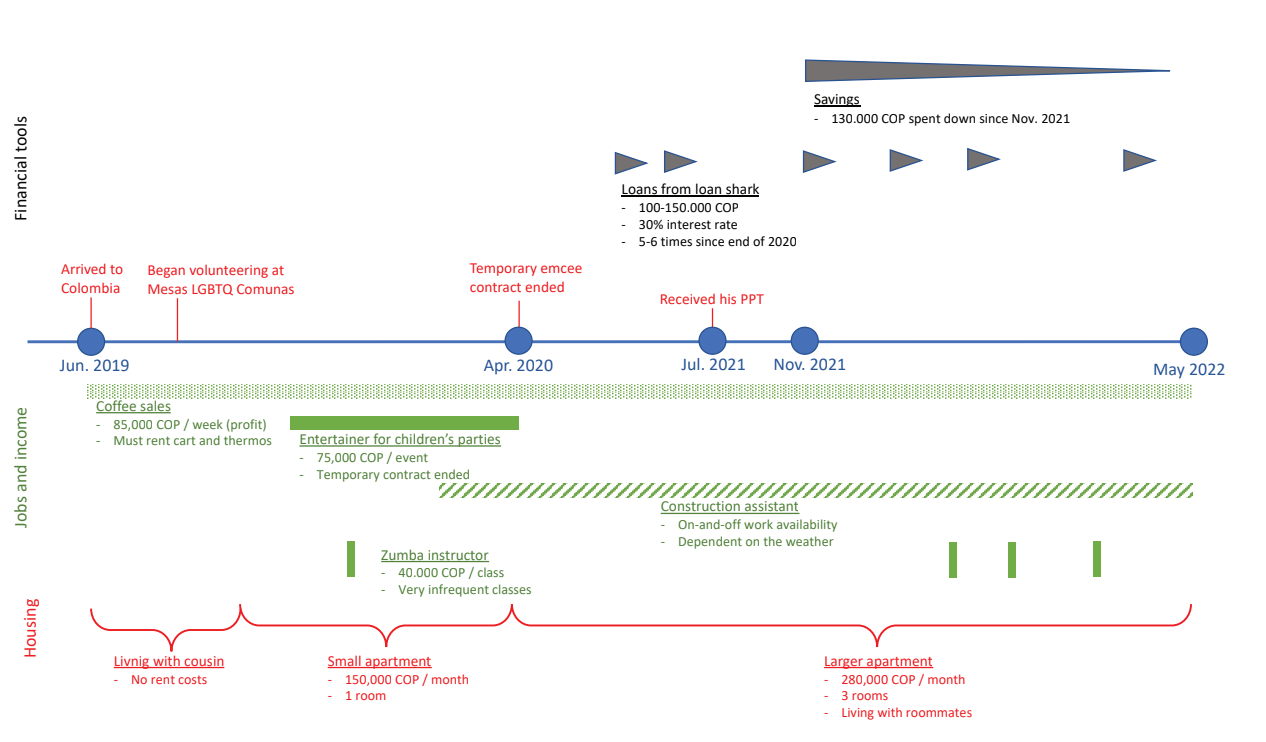

When Maikel could no longer access antiretroviral medications in Venezuela to support his health as an HIV-positive person, he knew he had to leave for Colombia. Thankfully, he was able to arrange to stay with his cousin and her husband who were already in Medellín. He is Wayúu, the ethnic group that controls the Maicao border, so unlike many others who are harassed, robbed, or worse, Maikel crossed the border without trouble. He came with $100 USD in cash and a big bag of his clothes.

He left behind his job as a primary school teacher, a position he loved even when the salary became effectively meaningless due to inflation. He knew his post-graduate degree in environmental education was unlikely to be recognized in Colombia, but he was ready to take on any new jobs that could help him start up his new life in Medellín.

Once Maikel arrived in Medellín, his cousins hosted him at their house and taught him how and where to sell coffee from a small cart in parks. Today, in 2022, he still follows the same process they showed him in 2019: he borrows a small coffee cart and thermos from a business owner in exchange for buying all the materials from that person. They also hold his ID as collateral for the cart. He sells coffee, hot chocolate, milk, cookies, and other small items in a popular park from 5 a.m. to 9 p.m. He has developed friendships with regular clients he says are “like family.”

They come back each day, and sometimes he lets them buy their coffee on credit or through informal exchange.

Maikel began actively volunteering in his community two months after arriving. A friend referred him to an LGBTQ+ organization in his area, Mesas LGBTQ Comunas, that provides trauma support, raises awareness about violence against LGBTQ+ people, and organizes marches and youth celebrations.

With his growing social network, Maikel made connections that led him to other side hustles in addition to selling coffee. He works as a construction assistant, an emcee, and a Zumba instructor—each with varying regularity, profitability, and passion. One year after arriving, he was able to support himself more independently and began renting a tiny apartment for $37 USD per month.

Having multiple income streams has helped Maikel shift and balance his work schedule as circumstances or his needs change. When construction work is put on hold because of rain, he can turn to selling coffee or another side hustle. His emcee work may take place on days off from construction jobs, and he can sell coffee in the hours around the other jobs. When he needs higher income, he can often fit these complementary schedules together to work more. However, juggling long hours and reporting to multiple bosses is stressful, and he feels exhausted and overworked during these times.

Having diverse jobs has helped Maikel weather financial storms. Three of his income streams were wiped out at the beginning of the COVID-19 pandemic, when street-selling and all in-person gatherings were prohibited. Fortunately, he was able to continue his construction work throughout that period, though he was barely keeping afloat, relying heavily on his savings.

Although Maikel’s multiple jobs create a buffer, he also takes a big hit when one of them falls through. For example, when his temporary contract as an emcee for children’s events ended, Maikel scrambled to make ends meet without the income from his most lucrative hustle. He quickly burned through the $317 USD in savings he had been accumulating and had to take out a loan from a loan shark. Although he recognizes the 30% interest rate is steep, he has found loan sharks’ services useful in a pinch. He has used them on five occasions, each time for around $24–37 USD. He currently has an outstanding loan for $37 USD, and he will need to pay back $54 USD by the end of the month.

In early 2022, Maikel believed he could afford higher rent with the income from his various hustles and the savings he had accumulated through his work. He moved into a larger house with roommates, paying $68 USD per month, where he currently lives. However, soon after he moved, he lost his contract to emcee children’s events. Without this income, Maikel has to rely more often on loan sharks and cannot send his usual remittances of $12–24 USD per month to his mother.

Maikel has held his Permiso por Protección Temporal (PPT) since soon after the status became available for Venezuelans in 2021. The application process was expedited to a matter of weeks because he is HIV-positive. Having the PPT provides access to state-subsidized healthcare and antiretroviral medication, which has been critical to his health and reduced expenses, as he no longer has to purchase the medication himself. Maikel also dreams about what he can do with the formal work authorization he received through the PPT. The event emcee company has hinted at hiring him under a formal contract.

His boss called him recently about his availability, so he is hopeful. The consistent pay and higher earnings would enable him to resume sending remittances home and rebuild his savings.

Perhaps one day, he could invest in buying his own coffee cart and thermos so he won’t have to rent them every day.

Without the emcee job, Maikel is making ends meet through diligent saving and skillful juggling of his other three jobs. When asked which of his multiple hats he most identifies with, despite rarely getting to teach Zumba classes in the past few years, he answers with a twinkle in his eye:

“Pero claro, I’m a Zumba instructor! Vamos, I’ll show you!”

Maikel’s Monthly Budget

Income and Expenses (Approximate)

| Income | Amount (USD) |

|---|---|

| Coffee sales | $151.22 |

| Construction (sporadic) | $73.17 |

| Zumba instructor | $9.76 |

| Emcee for events (currently unemployed) | $73.17 (not included in total) |

| Total Income | $234.15 |

| Expenses | Amount (USD) |

|---|---|

| Rent | $68.29 |

| Utilities | $24.39 |

| Food | $53.66 |

| Remittances | $12.20 (can’t afford currently; not included in total) |

| Coffee business supplies/rentals | $68.29 |

| Loan shark principal | $36.59 |

| Loan interest (20%) | $17.07 |

| Total Expenses | $268.29 |

Monthly Gain or Loss: –$34.14

Assets and Liabilities

| Assets | Amount (USD) |

|---|---|

| Savings (mattress) | $0 (prior savings wiped out) |

| Accounts receivable (money owed by customers) | $6.10 |

| Inventory (coffee supplies) | $6.10 |

| Stove | $24.39 |

| Cell phone | $30.49 |

| Total Assets (market value) | $67.07 |

| Liabilities | Amount (USD) |

|---|---|

| Paga Diario (loan shark) loan | $53.66 |

| Loans from family | $30.49 |

| Total Liabilities | $84.15 |

Initial Investment: $243.90

Retained Earnings (Losses): –$243.90

Net Worth: –$17.07